February 28, 2018

[caption id="attachment_22805" align="alignnone" width="1024"] Western Union, Singapore: In 2015, migrants sent home $441 billion – almost three times the total value of official development assistance (photo: iStock by GettyImages). [/caption]

Western Union, Singapore: In 2015, migrants sent home $441 billion – almost three times the total value of official development assistance (photo: iStock by GettyImages). [/caption]

Worldwide, 250 million people, or 3 percent of the global population, live outside their country of birth. Many of these migrants maintain strong ties with their home countries, sending part of their incomes to families back home. In 2015, migrants sent home $441 billion – almost three times the total value of official development assistance.

About 45 percent of these remittances flow from advanced economies to emerging market and developing economies. These funds have the potential to be an important mechanism for sharing income risks on a global scale. That is, if a family living in a developing country loses part of its income, higher remittances from relatives abroad could help compensate.

Limited risk-sharing through financial integration

In many emerging market and developing countries, remittances from migrants abroad help households maintain spending when times are tough and incomes decline. In principle, integration into the global financial system could help smooth the effect of income shocks on household consumption through borrowing and lending in capital markets. Countries could borrow more when their income drops temporarily.

However, poorer countries are often weakly integrated into global markets and cannot rely on them to help smooth consumption. Our study in the October 2017 World Economic Outlook (see Box 1.5) calculates the extent to which remittances can fulfill this role, under what circumstances, and with what country characteristics.

These money flows are particularly important because recipients in developing countries often do not have bank accounts or access to credit. Take the example of a coffee farmer in Ethiopia. When coffee prices fall, the farmer’s income declines. The farmer cannot easily make up for that by borrowing money, as a farmer in Italy with a credit card might.

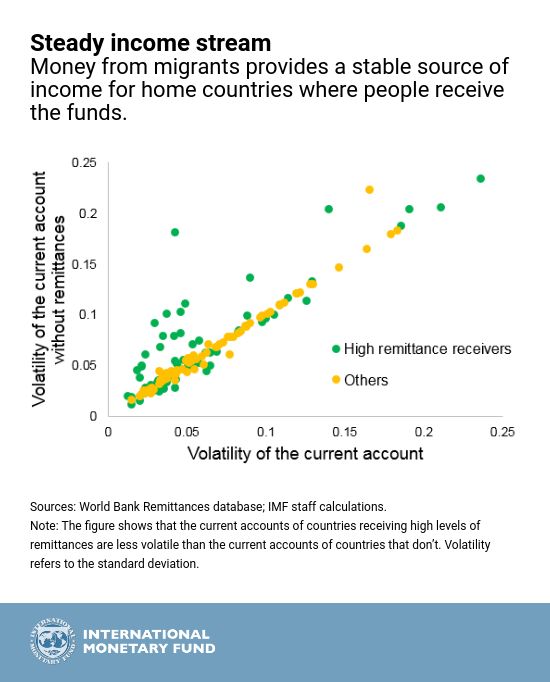

Remittances are a stable source of income

What matters directly for societal welfare is how much household consumption is stabilized following shocks to domestic income. A first stab at determining whether remittances help to stabilize household consumption is to determine whether they are a stable source of income.

The data show that remittances are in fact the least volatile component of balance-of-payments inflows. We analyze each country’s current account, or the sum of trade balance and net income from abroad including remittances. Volatility of the current account is significantly lower for countries receiving high net remittances than for countries without significant remittances.

Remittances facilitate consumption smoothing

Our study confirms that remittances facilitate consumption smoothing. We first calculate how effective individual countries are at mitigating the impact that income shocks have on consumption or smoothing consumption. On a broad basis across countries, we estimate that about 30 percent of income variation is not reflected in consumption or is smoothed, which would be consistent with partial risk-sharing. In other words, for any extra dollar of income that is lost in the home country, consumption falls by only 70 cents because of consumption-smoothing. Of the income variation that is smoothed, about 27 percent is due to remittances. This estimate holds regardless of whether a country receives a high or a low level of remittances and regardless of the extent to which the country is financially integrated.

This smoothing effect can be somewhat larger as a proportion of the total smoothed component during major country-specific financial crises. This consumption-smoothing effect is also more pronounced for commodity-exporting countries, especially during periods of low commodity prices.

Remittances can help

The lesson, then, is that remittances, or the money migrant workers send home, work like a global insurance policy for economic shocks. Measures that promote remittances, preserve correspondent banking relationships, and reduce the cost of remittances can significantly enhance worldwide risk-sharing – making everyone better off.